Moomoo Canada Deep Dive: Fees, Features and Account Types for Canadian Investors (2025)

How does Moomoo brokerage compare to other investing platforms such as Wealthsimple, Questrade and others? Let’s explore Moomoo AI, advanced orderflow features, competitive fees and more!

Moomoo Canada has quickly emerged as a notable player in the Canadian online brokerage landscape since its launch in September 2023. As a subsidiary of NASDAQ-listed Futu Holdings Limited, Moomoo brings a global reputation for advanced trading tools and competitive pricing to Canadian investors. But how does it stack up for those looking to manage their investments in Canada? Let’s break down what Moomoo Canada offers.

Sign Up Bonus

By signing up using our link serenomoney.com/moomoo you will receive

+$50 cash back with your first $100 deposit

+60 days of commission free trading (Up to $2000)

+$6% interest on your idle cash (Up to $10,000)

Registration is simple and can be done in just a few minutes!

Regulation and Security: Is Moomoo Canada Safe?

One of the most crucial considerations for any investor is the security of their funds. Moomoo Financial Canada Inc. is a registered member of the Canadian Investment Regulatory Organization (CIRO) and the Canadian Investor Protection Fund (CIPF). This means your investments are protected up to $1 million per general account in the event of broker insolvency, providing a significant layer of security and peace of mind for Canadian users. Moomoo is also registered with securities regulators in Alberta, British Columbia, Manitoba, New Brunswick, Nova Scotia, Ontario, Prince Edward Island, Quebec, and Saskatchewan, and is a non-trading member of the TSX and TSX Venture Exchange.

Fees and Commissions: Competitive Pricing for Active Traders

Moomoo Canada positions itself as a low-cost option, particularly for trading U.S. and Canadian stocks, ETFs, and options.

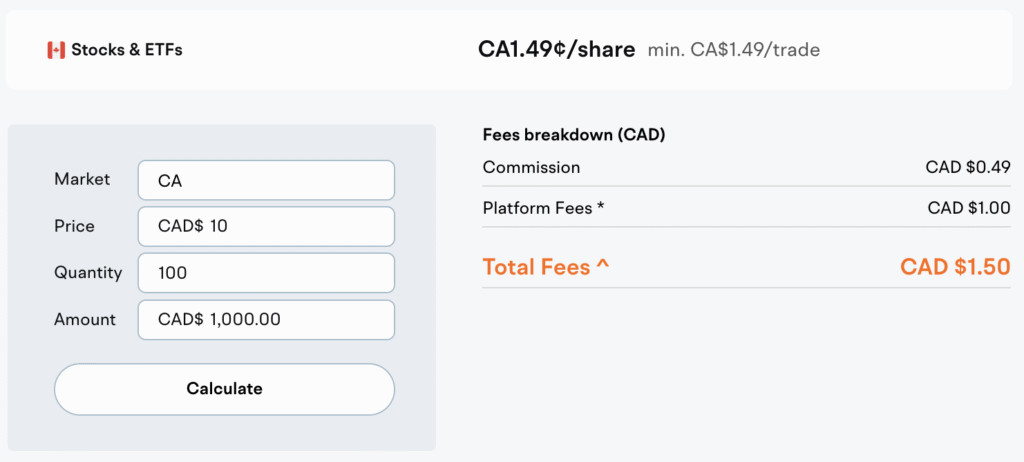

- Canadian Stocks & ETFs: Commission is $0.0049/share, with a minimum of $0.49/order. A platform fee of $0.01/share (minimum $1/order, capped at 0.5% of the transaction amount) also applies.

- Example: On a $1000 volume trade, your total fees will be CAD $1.50

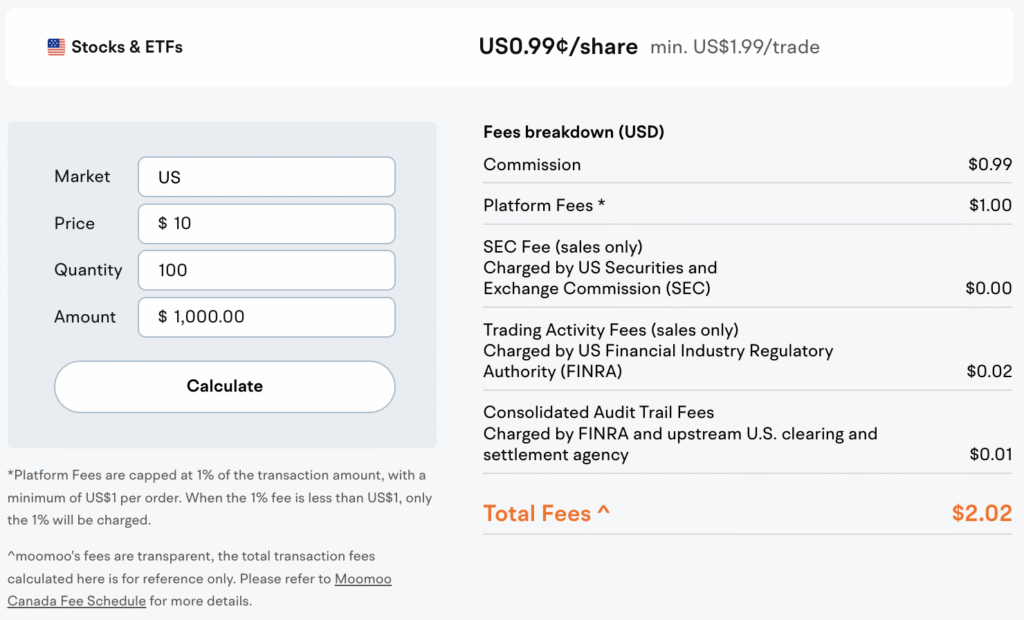

- U.S. Stocks & ETFs: Commission is $0.0099/share, with a minimum of $1.99/order. A platform fee of $0.005/share (minimum $1/order, capped at 1% of the transaction amount) also applies.

- Example: On a $1000 volume trade, your total fees will be USD $2.02.

- U.S. Options: Fees are $0.65/contract, with a minimum of $1/order.

- Currency Conversion: A competitive fee of 0.09% plus USD $2 for amounts under $100,000.

- If you’re converting any amount greater than $142 USD, you will save money compared to other brokers that charge a fixed 1.5% conversion fee.

- Account Fees: There are no account maintenance fees or inactivity fees, and no account minimums, making it accessible for investors of all sizes.

- No Cap on Trading Fees: While fees are generally low, it’s important to note that there is no cap on trading fees for large blocks of shares, which could lead to higher costs for very large transactions compared to some other brokers that have maximum trading fees.

Investment Products and Account Types

Moomoo Canada currently offers a focused selection of investment products and account types:

- Tradable Instruments: You can trade Canadian and U.S. stocks, ETFs, and U.S. options.

- Account Types: Moomoo Canada supports Registered Retirement Savings Plans (RRSP), Tax-Free Savings Accounts (TFSA), Margin accounts, and Cash accounts. It’s worth noting that they do not currently offer First Home Savings Accounts (FHSA), Registered Education Savings Plans (RESP), RIFs, LIRAs, corporate, or joint accounts.

Trading Platform and Features: Designed for the Active Investor

Moomoo’s trading platform is a standout feature, particularly for those seeking advanced tools and real-time data.

Mobile-First Approach: While there is a desktop app, Moomoo is heavily focused on its mobile application experience. There is no web-based trading platform.

User Interface: The mobile app is highly rated (4.5+ stars on Google Play and Apple App Store) for its ease of use and organized layout. While powerful, some beginners might find the desktop platform’s advanced features initially overwhelming.

Moomoo AI: An innovative and exciting feature is Moomoo’s AI tool. Have questions about Wall Street news or a stocks recent price movement? Moomoo AI is a helpful learning tool to assist you in understanding the markets. For example: I asked “What caused Nvdia’s recent price movement?” After about 20 seconds of reasoning with the “thoughts” displayed, here’s what it outputted:

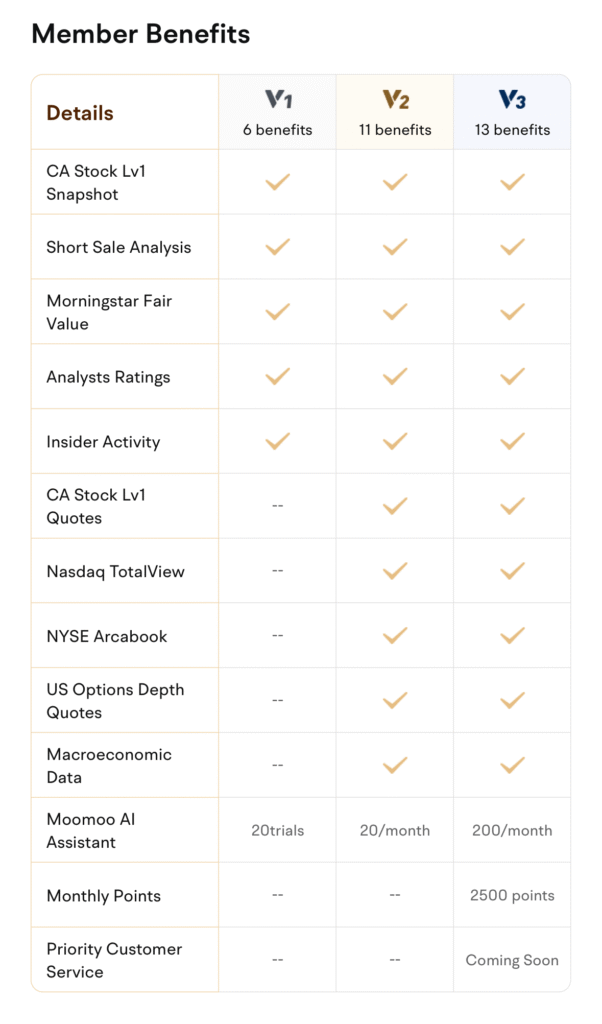

Pretty amazing right? There’s a plethora of information broken down into easy to read bullet points, with citation to the sources from SEC filings, WSJ articles, CNBC and other reputable sources. One downside is that you only get 20 free query trials where you will then have to upgrade to a V2 account type to get 20 queries a month.

Real-time Data: Moomoo provides free access to U.S. Level 2 market data (V2 account types), offering deep insights into market dynamics that are often premium features on other platforms. You also get real-time stock quotes and options chains.

Dynamic Orderflow Data: Moomoo provides premium level orderflow data even with the most basic account membership level. Some notable data points are money flows, daily short volumes, short interest, unusual options activity, top 0 DTE options and an options screener tool.

Advanced Trading Tools: The platform boasts over 100 technical indicators and 45 drawing tools, catering to both novice and experienced traders. Features like short sale volume analysis, institutional holdings, and company valuation tools are also available.

Extended Trading Hours: Trade U.S. stocks from 4:00 AM to 8:00 PM ET and Canadian stocks from 8:00 AM to 5:00 PM ET, offering more flexibility.

Paper Trading: A valuable feature for beginners and experienced traders alike, Moomoo offers a risk-free paper trading account with $1 million in virtual money to practice strategies.

Account Levels Explained

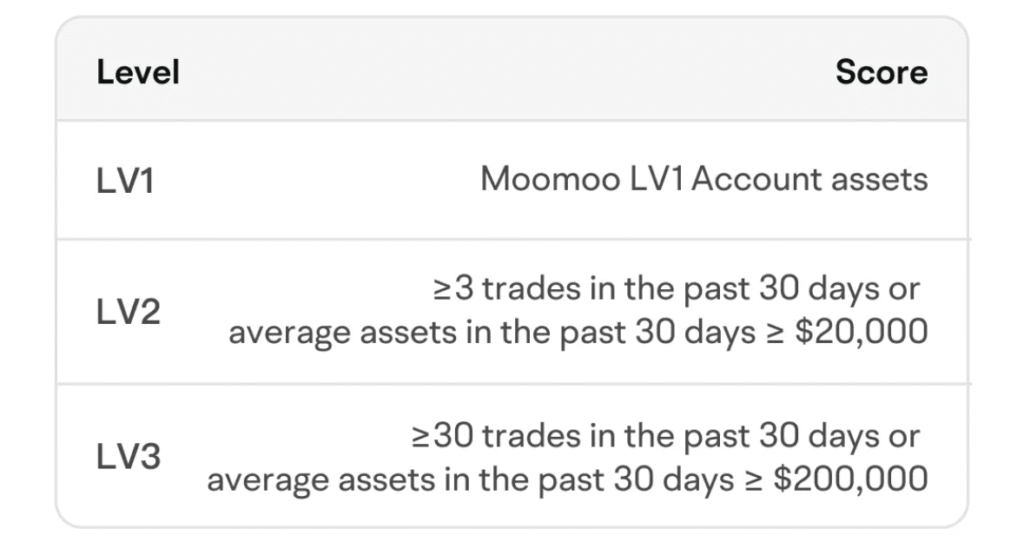

Moomoo has a 3 tier account system which grants you access to different perks and features. Here’s a simple breakdown at what you receive and how your upgrade your account.

Upgrading Your Member Level

Member Benefits

Pros and Cons of Moomoo Canada

Pros:

- Low Fees: Although not zero, Moomoo offers competitive commissions for U.S. and Canadian stocks, ETFs, and options.

- Foreign Exchange: Moomoo’s rate of 0.09% + $2 is much better than other brokerages who offer a fixed 1.5% fee for exchanging CAD and USD.

- No Account Minimums or Maintenance Fees: Accessible for all investor levels.

- Advanced Trading Tools: Free Level 2 market data, extensive technical indicators, and drawing tools.

- Extended Trading Hours: More flexibility for U.S. stock trading.

- Robust Mobile App: Highly rated for ease of use and features.

- Paper Trading: Risk-free environment to practice.

- Strong Regulation: CIRO and CIPF membership ensures investor protection.

- 24/7 Customer Support: Available via multiple channels.

- Comprehensive Educational Resources: A wide array of courses and a community forum.

- Interest on Uninvested Cash: Moomoo offers up to 6% interest on uninvested cash.

Cons:

- Limited Account Types: No FHSA, RESP, RIF, LIRA, corporate, or joint accounts.

- Limited Asset Classes: Primarily focuses on U.S. and Canadian stocks, ETFs, and U.S. options; no bonds or mutual funds.

- Missing Web-Based Platform: Trading is primarily through the desktop or mobile app.

- Uncapped Trading Fees: Could be more expensive for very large trades compared to some competitors.

- No In-Kind Transfers: Cannot transfer cash or securities in-kind into RRSP or TFSA accounts.

- Interface Complexity: Advanced features might be overwhelming for absolute beginners.

Conclusion: Is Moomoo Canada Right for You?

Moomoo Canada is a compelling choice for active traders and experienced investors who prioritize low fees, advanced analytical tools, and real-time market data. Its robust mobile platform, extended trading hours, and comprehensive research resources make it a strong contender for those looking to take a hands-on approach to their U.S. and Canadian equity and options trading.

However, if you’re a beginner looking for a very simple interface, need a wider range of account types (like FHSA or RESP), or want to invest in a broader array of asset classes (like mutual funds or bonds), Moomoo Canada might not be the perfect fit. Always consider your individual investment goals, trading style, and preferred account types before choosing a brokerage.

Sign Up Rewards

If it sounds like Moomoo is right for you, or you’re just curious and want to try it out, Moomoo is running some great incentives to get your account up and running.

By signing up using our link serenomoney.com/moomoo you will receive

+$50 cash back with your first $100 deposit

+60 days of commission free trading (Up to $2000)

+$6% interest on your idle cash (Up to $10,000)

Registration is simple and can be done in just a few minutes!

Disclaimer: The information provided in this article is for informational purposes only and should not be considered financial advice. Investing in cryptocurrencies involves significant risk, and you could lose money. Always do your own research and consult with a qualified financial advisor before making any investment decisions. Serenomoney.com may get compensated for sign-ups from affiliate links embedded in this article.