Save Money When Buying Crypto In Canada: Fees & Spreads Explained

Are you one of the many Canadian crypto investors that is unknowingly paying substantial fees to buy crypto on an exchange in Canada?

Some platforms hide the true cost of investing in crypto to their customers.

If you aren’t informed on all of the costs associated with buying crypto, you may be getting less coins for your money and not even realizing it.

Today we’ll dive into fees, commissions and spreads. Empowering you to stop overpaying and get more crypto for your money.

We’ve also done the market testing ourselves, and at the end will recommend the two lowest cost regulated trading platforms for Canadian crypto investors.

Table Of Contents

Fees and Commissions Explained

Exchanges may charge fees for deposits, withdraws, and trading. We’ll focus on fees for trading in this article as they are the cost that is incurred most often.

Commissions are another way to say fees, specifically for the cost of filling a buy or sell order on a platform.

Most platforms are transparent about these type of fees, with some platforms charging “zero” commissions while others charge as high as 2% per order!

Even though a platform may charge “zero” fees, this is a misleading way of representing the true cost to the trader because of something called spreads that we’ll explain later.

The Simple Math Behind Fees:

If I’m an investor purchasing $1000 worth of bitcoin on a platform that charges 2% fees, my cost will be $20. $1000 x 2% = $20, meaning I really only get $980 worth of bitcoin.

Compare this to a platform that charges a 0.2% fee. This same $1000 order will only cost me $2 in fees, 1/10th of the cost of a 2% commission. $1000 x 0.2% = $2.

Although these numbers may seem small initially, it’s probably fair to assume you’re purchasing crypto expecting a future appreciation in price. If this is the case, (maybe you buy crypto to lose money?) the cost of fees will only compound if your initial investment appreciates.

However, fees don’t give the full picture of the true cost to investors. To fully understand this, we must look at the spreads on each platform which are often overlooked.

Spreads Explained

Skip to Spreads TLDR if you want to skip the technical explanation and just want to know how to save money when you buy and sell crypto. LINK!!!

To understand spreads, we must start with the basics of how a market works.

Markets are made up of buyers and sellers that come together to form a consensus on the current price of an asset at a current point in time.

To visualize the concept of spreads, we’ll use a picture of a real order book from an exchange here in Canada.

In this order book, we can see a full list of traders both buying and selling bitcoin, with the quantity they are offering and the total bitcoin offered at that price.

For our example, we don’t need to worry about quantity and will instead just focus on the bid price and ask price.

In our image the top horizontal green strip you can see that someone is offering to buy bitcoin at $158,400. This means they placed a limit order, adding liquidity to the order book, making a commitment to buy bitcoin at $158,400. This price is the highest someone is willing to pay for bitcoin right now in this market and is known as the bid.

In the section above, the lowest red horizontal strip shows the ask price. This is the lowest price that someone is willing to sell bitcoin, in this case $159,012.5.

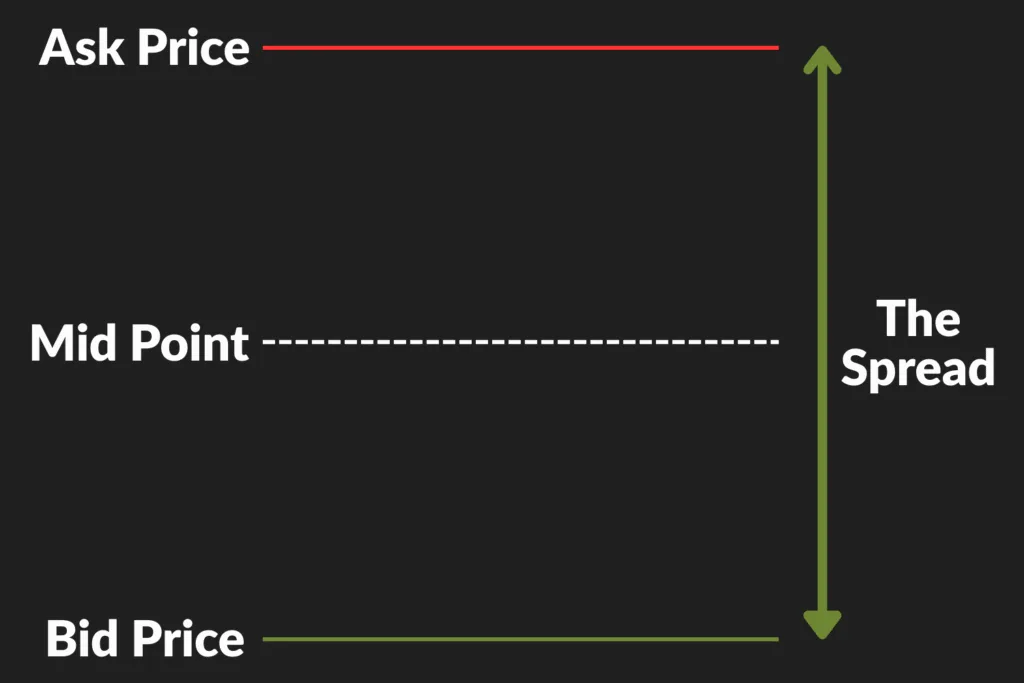

If you look closely, you’ll notice that there is a gap between the ask price and the bid price.

This gap is known as the spread, in our case it’s $159,012.5-$158,400 = $612.5.

When you place a market order to buy bitcoin you have to cross the spread and get filled at the ask price (the lowest someone is willing to sell bitcoin for).

Let’s say you are buying 1 bitcoin. This will cost you $159,012.5 (assuming there is a full bitcoin of liquidity on the ask).

The cost of spread can be easily realized if you were to turn around instantly and sell your bitcoin right back to the exchange. Let’s assume the market price hasn’t moved and you want to place a market sell order.

For this order, you’d have to cross the spread and get filled on the bid (the highest price a trader is wiling to buy bitcoin at). You wouldn’t get $158,400 for your bitcoin.

Again, the difference between these two prices is the spread. You incurred a cost of $612.5 or an extra 0.39%.

Compare this to another exchange with high liquidity and tighter spreads.

Here the spread cost is significantly smaller at only $33.5 between the bid and the ask. Therefore you get more bitcoin for your dollars when you buy and more dollars for your bitcoin when you sell.

Spreads TLDR

There is a gap in the prices between where buyers and sellers meet.

On some exchanges this gap is substantial (+1%), and on others it’s quite minimal (0.02%).

The larger the gap the more cost you will incur when buying and selling with a market order.

You want to trade on exchanges with a small spread as their is less distance between other buy and sell orders, meaning you get a better deal for your crypto when both buying and selling.

The Two Lowest Cost Platforms For Canadian Investors

After investigating both the fixed commissions and spread conditions of the order books, we have found the two best exchanges that offer the lowest total trading fees.

Kraken Pro

Kraken Pro’s fee’s are 0.4% for taker (market orders) and 0.25% for maker (limit orders).

When combined with extremely tight spreads that range from 0.01%-0.05% this creates an optimal trading environment for saving capital on both fees and spreads.

Note: It’s important that you use Kraken Pro rather than the regular Kraken site to get the noted fee savings.

On an $1000 bitcoin market order, you will be charged 0.4% ($4) for flat fees and up to 0.05% ($0.50) for spread related costs. Meaning a total of ~0.45% or $4.5 in total fees.

Kraken Pro Sign-Up Bonus

Kraken is currently offering $50 CAD to new traders who sign up, deposit 200 CAD and trade 200 CAD in crypto in their first days.

Serenomoney.com/Kraken

By signing up using our link, you help support our mission of providing valuable and accessible information to DIY investors.

Ndax.io

Ndax.io charges a flat 0.2% for both maker (limit) and taker (market) orders.

However, they have a bit wider spreads on their platform hovering around ~0.4%.

On an $1000 bitcoin market order, you will be charged 0.2% ($2) for flat fees and around 0.4% ($4) for spread related costs. Meaning a total of ~0.6% or $6 in fees.

Ndax.io Sign-Up Bonus

Ndax.io is currently offering a $10 bonus on for new users who deposit their first $100 into the platform.

Serenomoney.com/NDAX

By signing up using our link, you help support our mission of providing valuable and accessible information to DIY investors.

Why Spreads and Fees Matter

Whether you are a casual investor or an active speculator, saving on fees is crucial and one of the easiest choices you can make to increase your investment gain. We hope with this article you are more informed about your choices and can vote with your dollars to support the best photos for you.

Spreads and Fees Explained YouTube Video

Watch the Sereno Money YouTube video about buying crypto such as Bitcoin, Ethereum and Solana on Canadian exchanges while saving money on fees. We discuss fees, commissions, and spreads and how these effect your costs. We also highlight the top 2 lowest-fee Canadian crypto exchanges being Kraken Pro and Ndax.io.

Disclaimers

The content in this article is for informational and educational purposes only and should not be considered financial, investment, or tax advice. Always do your own research or consult with a qualified financial advisor before making any investment decisions.

Some of the links in this article are affiliate links, which means we may earn a commission if you choose to sign up through them—at no additional cost to you. These partnerships help support the site and allow us to continue creating free content. We only recommend services we genuinely believe provide value to investors.

All information in this article is accurate to the best of our knowledge at the time of publication. However, brokerage features, fees, promotions, and platform offerings may change over time. Please visit the official broker websites for the most up-to-date details before making a decision